2025 Healthcare Cost Outlook | Drivers & Trend Insights

Employee Benefits

2025 Healthcare Cost Outlook | Drivers & Trend Insights

Large employers continue to encounter significant financial headwinds in finalizing their 2025 healthcare budgets, exacerbating the challenge of managing affordability for their employees and dependents. Cost drivers for 2025 will sound familiar to the prior year but have persisted at historically high levels.

According to results from a recent Brown & Brown analysis of large employers, employers expect their healthcare costs to increase an average of 6.7% for 2025 after accounting for changes to their plan offerings (including plan design changes and types of plans being offered). If no changes were made to plan offerings, employers would have expected an increase of 7.7%.

Other industry sources are projecting similar increases for 2025:

- The Centers for Medicare and Medicaid Services (CMS)1 have projected annual cost increases per enrollee of 6.0% and 5.0% in 2024 and 2025, respectively, before stabilizing to slightly below 5.0% for 2026 through 2032.

- Business Group on Health2 members expect a 6.6% increase in costs for 2025 after plan changes (7.8% before plan changes).

Employers must now more than ever keenly monitor their health plan claims experience and proactively manage costs. While traditional cost management techniques (e.g., changes to plan designs/offerings and employee contributions) are limited to annual renewal cycles, other approaches can be implemented throughout a plan year.

Four Key Cost Drivers

- Broader Economic Environment

- Prescription Drugs

- Behavioral Health

- Increasing Volume of Large Claimants

A Closer Look at Four Key Cost Drivers for Employers

-

Broader Economic Environment (Inflation & Labor Market)

Healthcare providers have battled significant financial challenges for the past several years, driven by the increased cost of care. Increased operating expenses for labor, supplies and infrastructure have outpaced increases in reimbursement rates. This environment has led to a compounding effect on provider contract negotiations. Based on conversations with national carriers, underlying medical trends are expected to include an additional 0.5%-1.0% for 2025, reflecting the expected inflationary and labor market impacts.

While broader inflation markers have been trending closer to targets, medical inflation can lag by as much as 12 months because of the three-year term of many provider contracts. The initial impacts of these contract renewals were seen in 2023 and 2024, but they are anticipated to continue into 2025 and beyond. Elevated costs for services will likely drive increases in costs for employers due to these renegotiated contracts.

Provider consolidation has also led to increased reimbursements, driven by additional market leverage gained via consolidation. Private equity-owned facilities and physician groups have also been associated with higher healthcare spend.

-

Prescription Drugs – GLP-1 and Biosimilars

Similar to prior years, prescription drug costs continue to increase at a significantly higher rate than medical services. Undoubtedly, GLP-1 drugs, both for diabetes and weight loss, have been a constant topic of discussion around top cost drivers.

Commercial health plans have commonly experienced high double-digit claim trends into 2023 and 2024. These high trends are expected to continue in 2025 as growing demand for these medications continues to exceed supply. Additionally, studies have found GLP-1s to be effective in reducing the risk of cardiovascular mortality, myocardial infarction and stroke. These new indications will likely drive an additional spike in utilization in the future.

In addition to the existing cost management challenge for GLP-1s, the emerging drug pipeline includes costly new therapies displacing lower-cost ones for prevalent conditions such as migraine and skin care.

The impact of biosimilars as a cost deflator has been slower than expected. Most plans’ highest-cost medication had typically been Humira®, and several biosimilars were approved in 2024. Employers will have an opportunity to drive savings and offset increased costs elsewhere by shifting utilization to these biosimilars. Several PBMs have announced changes to their formulary strategy, including removing Humira from standard formularies.

-

Behavioral Health

Behavioral health claims still have a relatively small share of total claims (~10% of medical dollars3). Nevertheless, many employers have seen behavioral health claims trend in the mid-teens, and some have seen the category emerge in their top five spend areas. The driving area of utilization is high frequency, low severity visits (outpatient therapy). This benefit continues to gain traction with younger generations, and as a result, many carriers have been expanding their network to address access issues. This network expansion, however, will likely lead to higher reimbursements to providers, applying further pressure on broader unit cost inflation.

While the low severity, high-frequency utilization of mental health services is typically seen as a positive sign in a customer’s population well-being, strategic considerations could include evaluating carrier-integrated or third-party solutions specializing in self-care or virtual care offerings.

-

Increasing Volume of Large Claimants

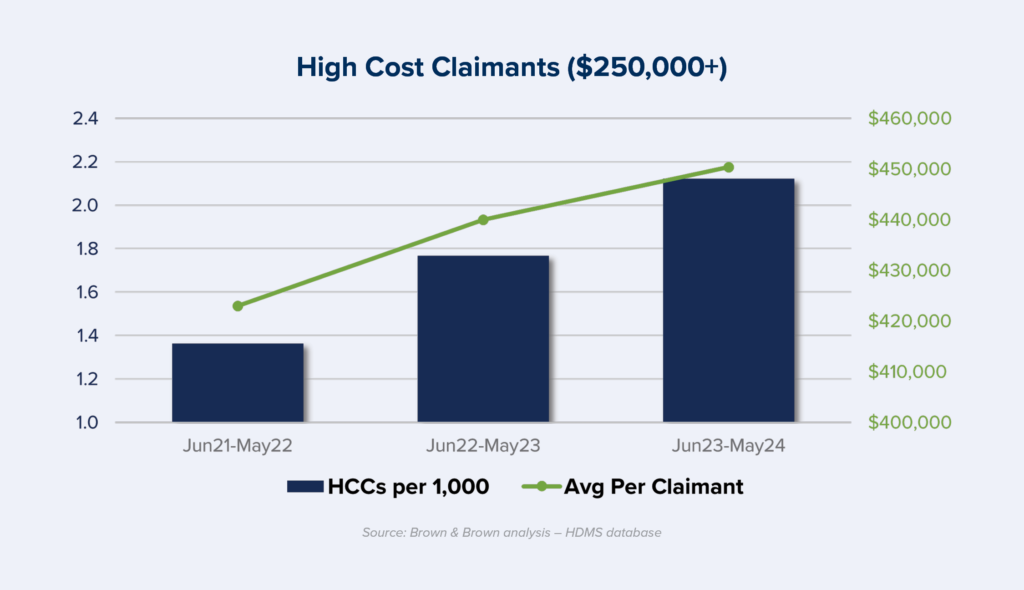

The volume of large claimants has increased dramatically in the post-pandemic period, not just truly catastrophic million-dollar claimants but those that would not reach typical stop-loss thresholds. The number of claimants incurring $250,000 (per 1,000 members) increased by over 50% from mid-2021 through mid-2024 (see chart). While there has been a dramatic increase in volume, there has not been a corresponding increase in severity; the average cost per claimant remained relatively stable over this same period. This increase in the number of large claimants can be explained by several components, including a higher prevalence of chronic conditions, more costly treatments (e.g., gene therapies), new technology and an aging population.

For most employers, cancer is the top condition for large claimants4. New costly therapies, including CAR-T therapies, have been developed to treat various cancers. The complexities of producing and supplying these drugs have resulted in both cost and access issues.

Other cancers are tied to lifestyle factors, including diet, smoking and alcohol intake. Effective employer well-being programs can address the onset of chronic conditions that could lead to various cancers in the future.

Employer Actions to Consider

Continue to Review Cost Management Strategy

- Reevaluate how well current programs are working and what changes (if any) are necessary – including plan designs, network strategy and clinical programs.

GLP-1 Management Strategy

- Several PBMs have introduced utilization management modifications to specifically address GLP-1 medications. There are a number of management thresholds to cater to an employer’s GLP-1 strategy.

- Given that less than half of those prescribed GLP-1s for weight keep taking them for at least 12 weeks,5 long-term projections expect GLP-1 coverage for weight loss to run as a net loss to health plans. The weight is not kept off long enough to avert the associated costly medical conditions and outcomes, whose avoidance would have driven longer-term savings.

- For customers not interested in excluding coverage for weight loss, some cost mitigation measures could include introducing a program engagement requirement or increasing the BMI standards above the FDA levels to decrease some eligibility.

Budget-Setting

- Be proactive regarding higher-than-expected future costs and engage financial colleagues earlier to manage their expectations and set budget assumptions accordingly.

Large Claimant Activity

- Request carriers to provide ongoing notifications of high-cost claimant activity as early as possible in the claims adjudication process.

- Review current case management strategy with carriers and identify opportunities for enhancement.

- Reevaluate current stop-loss coverage to determine the most appropriate specific deductible for your organization’s risk appetite.

- Consider expanding Centers of Excellence to treat specific complex diseases to improve outcomes and cost efficiency.

Employers should expect financial headwinds to persist over the next few years – driven by unit cost and utilization. By taking proactive action and working with carriers, pharmacy benefit managers and advisors, employers can position themselves to manage these emerging risks within their broader health plan strategy. Employers should push their vendors to share more detailed data on a timelier basis to help better forecast emerging cost drivers, monitor and actively manage the areas described above, and course correct as necessary.

1. Centers for Medicare & Medicaid Services, Office of the Actuary – https://www.healthaffairs.org/doi/10.1377/hlthaff.2024.00469

2. Business Group on Health, “2025 Large Employer Health Care Strategy Survey” – https://www.businessgrouphealth.org/resources/2025-employer-health-care-strategysurvey-intro

3. Brown & Brown Claims Data Warehouse

4. Brown & Brown Claims Data Warehouse

5. Blue Health Intelligence® Issue Brief May 2024: “Real-World Trends in GLP-1 Treatment Persistence and Prescribing for Weight Management” – https://www.bcbs.com/media/pdf/BHI_Issue_Brief_GLP1_Trends.pdf