Short-Term Limited Duration Insurance

Employee Benefits

Short-Term Limited Duration Insurance

On March 28, 2024, the U.S. Departments of Health & Human Services, Labor and Treasury (the “tri-agencies”) released final rules related to both Short-Term Limited Duration Insurance (STLDI) and Fixed Indemnity policies. The focus of this article will be on the final rules impact on STLDI coverage, but information related to changes made to the rules surrounding fixed indemnity coverage can be found, here. These final rules amend the federal definition of STDLI and finalize these policies’ maximum total coverage period.

Insurers will be prohibited from issuing multiple STDLI policies to the same individual for over four months within one year to eliminate “stacking” of separate, sequential policies for a period that is longer than the intended use of STLDI coverage.

Background

STLDI policies were initially designed to provide very minimal coverage to individuals transitioning between plans/policies or from one employer’s group health plan of one employer to another.\

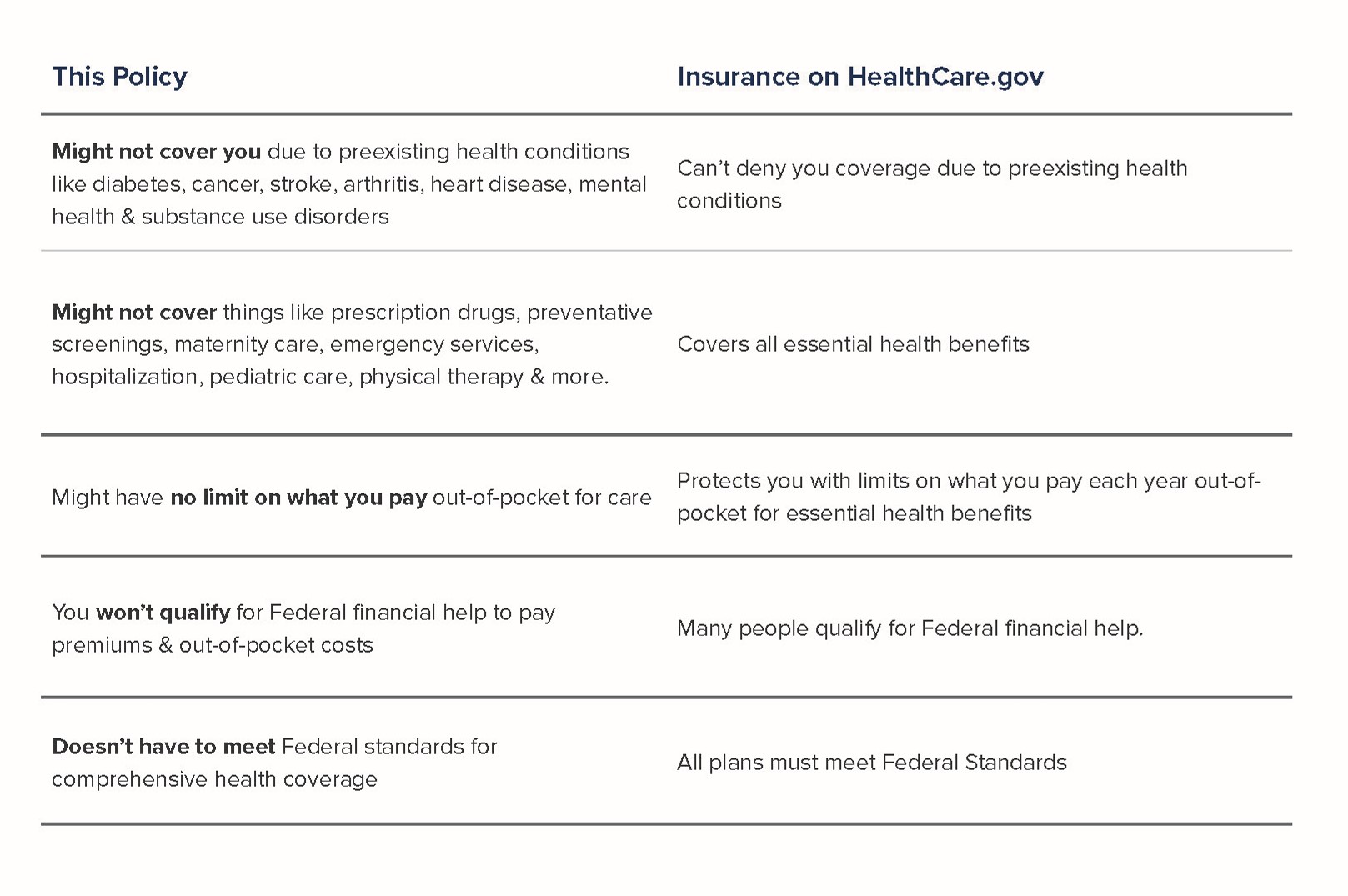

Because this coverage is offered at a lower cost than typical individual insurance coverage, it is exempt/excluded from many of the typical federal individual coverage protections (e.g., prohibition on discrimination based upon health status, pre-existing condition exclusions and annual/lifetime dollar maximums).

These plans are not intended to be used as an alternative to comprehensive coverage but instead have higher out-of-pocket costs and cover fewer services than traditional medical insurance. Previously, the government allowed these policies to have an initial contract term of less than 12 months, with a maximum total coverage period of up to 36 months, including renewals and any extensions to such coverage. The purpose of the final rules, therefore, is to reduce the overall length of time an individual may remain on an STLDI policy in a 12-month period.

STLDI Changes

These final rules amend the policy term of STLDI coverage, limiting STLDI policies to three months in duration, with a maximum coverage period of up to four months, including renewals and any extensions to such coverage. The rules also add required parameters around the maximum coverage period of an STLDI policy for up to four months. The four-month maximum STLDI coverage period includes all renewals/extensions sold by the same issuer, or any issuer member of the same controlled group, to the same policyholder within a 12-month period.

These requirements become effective on all STLDI policies/certificates/contracts issued on or after September 1, 2024.

For any STLDI policies/certificates/contracts coverage sold or issued before September 1, 2024, policies may continue to have an initial contract term of less than 12 months and up to a maximum duration of 36 months, subject to any limits under applicable state law. This includes any subsequent renewals/extensions consistent with applicable law.

The final rules also require a revised notice/disclosure to be distributed to individuals eligible for STLDI coverage and to be prominently displayed on the first page of the policy/certificate/contract of insurance, including renewals and extensions. It must also be on the first page of any marketing, application and enrollment materials. The revised notice is available on the next page of this article and page 23417 of the final regulations. It must be distributed to eligible individuals for all STDLI policies, certificates or contracts issued on or after September 1, 2024.

The revised rules on STDLI coverage aim to realign the federal definition of STDLI to its intended meaning: to serve as temporary coverage. These rules will help consumers differentiate between STDLI coverage and comprehensive coverage, helping to reduce the financial and health risks associated with choosing limited coverage over comprehensive coverage as a long-term solution to their healthcare needs.

For more information on these final rules related to STLDI coverage, click here.

STLDI Notice – Plans sold/issued on or after September 1, 2024

IMPORTANT: This is a short-term, limited-duration policy, NOT comprehensive health coverage

This is a temporary limited policy that has fewer benefits and Federal protections than other types of health insurance options, like those on Healthcare.gov.

Looking for comprehensive health insurance?

- Visit Healthcare.gov or call 1-800-318-2596 (TTY:1-855-889-4325) to find health coverage options.

- To find out if you can get health insurance through your job or a family member’s job, contact the employer.

Questions about this policy?

For questions or complaints about this policy, contact your State Department of Insurance. Find their number on

the National Association of Insurance Commissions’ website (naic.org) under “Insurance Departments”.