2025 FSA and Transportation Limit Updates

Employee Benefits

2025 FSA and Transportation Limit Updates

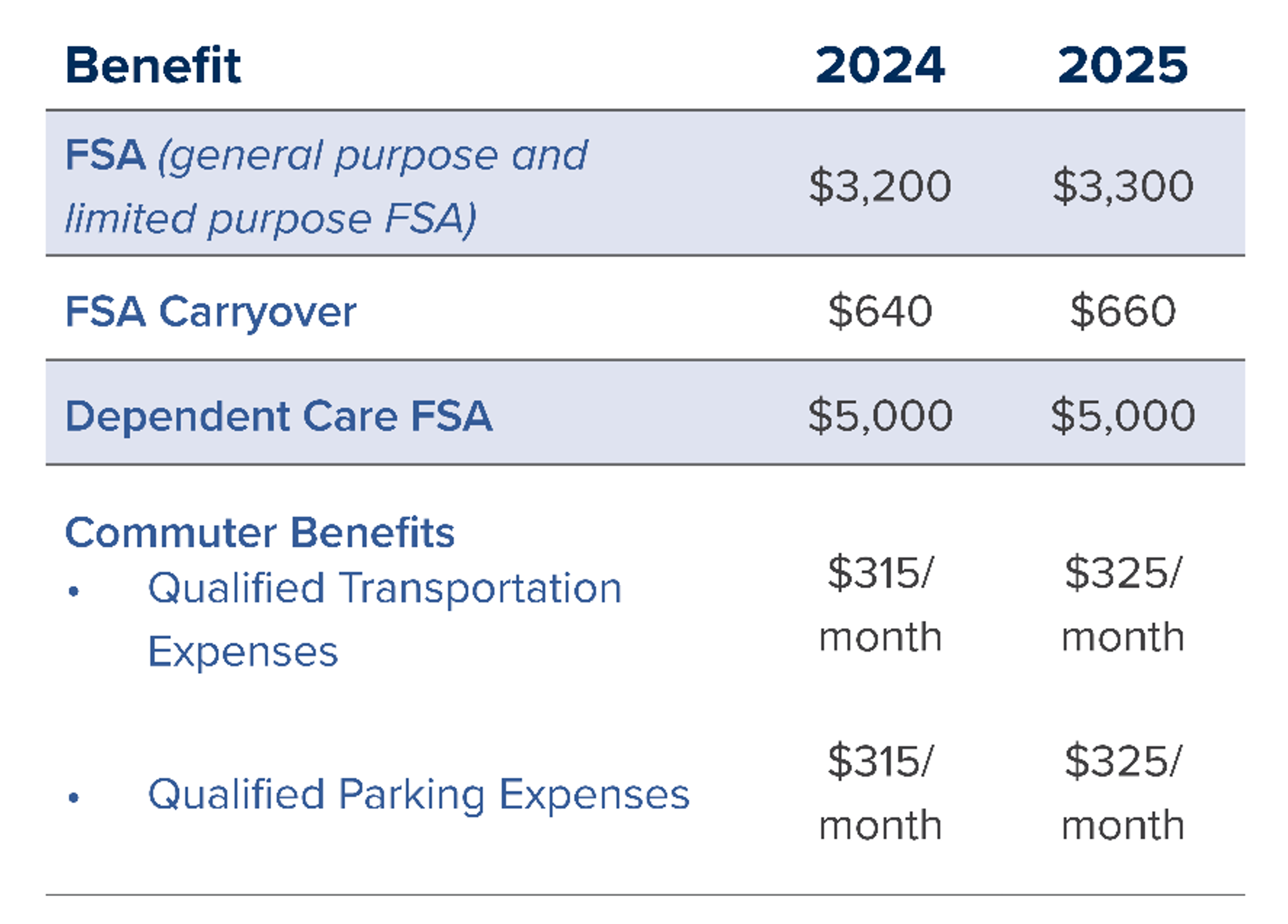

On October 22, 2024, the IRS released Revenue Procedure 2024-40, providing a list of inflationary adjustments made to certain employee health and welfare benefits (and other various items) for the 2025 calendar year, including:

- 2025 inflationary-adjusted health FSA employee contribution limits

- 2025 inflationary-adjusted qualified transportation fringe benefit reimbursement program limits

The new limits for these benefits are as follows:

1. Health FSA (for both general purpose and limited purpose health FSAs):

a. An employee may contribute a maximum of $3,300 to a health FSA for plan years beginning on or after January 1, 2025 (up from $3,200 in 2024).

b. An employee may carry over a maximum amount of $660 from a plan that has a plan year beginning on or after January 1, 2025, to the following plan year (up from $640 in 2024).

2. Commuter Transit/Qualified Parking Benefit Limits

a. For 2025, an employee may receive up to $325 per month in reimbursements for qualified transportation expenses (e.g., commuter highway vehicle, transit passes) (up from $315 in 2024).

b. For 2025, an employee may receive up to $325 per month in reimbursements for qualified parking expenses (up from $315 in 2024).

The maximum amount of dependent care FSA (DCAP) benefits that may be received on a tax-free basis during a calendar year has not changed and will continue to be $5,000 for most employees in 2025.

As a reminder, these annual adjustments are permissive, meaning employers/plan sponsors need not adopt the above inflationary adjustments within their plan. If an employer/plan sponsor chooses to adjust their employee contribution/reimbursement amounts, they should reflect such changes within their accompanying document(s) that describe the plan(s).